- #ACCESS BANK MOBILE APP INSTALL#

- #ACCESS BANK MOBILE APP UPDATE#

- #ACCESS BANK MOBILE APP DOWNLOAD#

If you are selling or discarding your telephone, remember to delete all your device’s data. Monitor your accounts on a regular basis and report any suspicious activity to your May Access Bank branch or to the Customer Care Center at 08. Even if you don't, we'll automatically disconnect you after you've been inactive after a few minutes. Confidential information from the mobile banking app is not stored on your phone, so when you sign out, your information stays secure. Be sure to "sign out" once you have completed your mobile banking session. Do not save your login credentials in your device, such as your User ID and password, in memos, images, screenshots, voice records, or your phone’s browser. Avoid storing private information on your phone. Never leave your mobile device unattended during an open mobile banking session. Mobile malware and viruses are getting very sophisticated and can capture your private data or even perform unauthorized transactions on your behalf. #ACCESS BANK MOBILE APP INSTALL#

Install an antivirus app and enable password protection if available for your device. Doing so may make it more vulnerable to malware and viruses and put your private information at risk. Do not jailbreak (iPhone®) or root (Android™) your phone or otherwise disable its built-in security features. Check if these permissions make sense, comparing with what the app is supposed to do. Every installed app asks for permissions to access your device’s data. #ACCESS BANK MOBILE APP DOWNLOAD#

Download only the apps from well-known publishers and that have high review scores. Use only well-known app stores such as the Apple App Store and Google Play to download new apps.

#ACCESS BANK MOBILE APP UPDATE#

Update other applications that you use, too, as application publishers are constantly applying security patches along with new versions of their app. These are designed to provide you with protection from known possible security problems. Download and apply security updates provided by Apple and Google. You can download the official app directly from a trusted repository like Apple Store or Google Play.

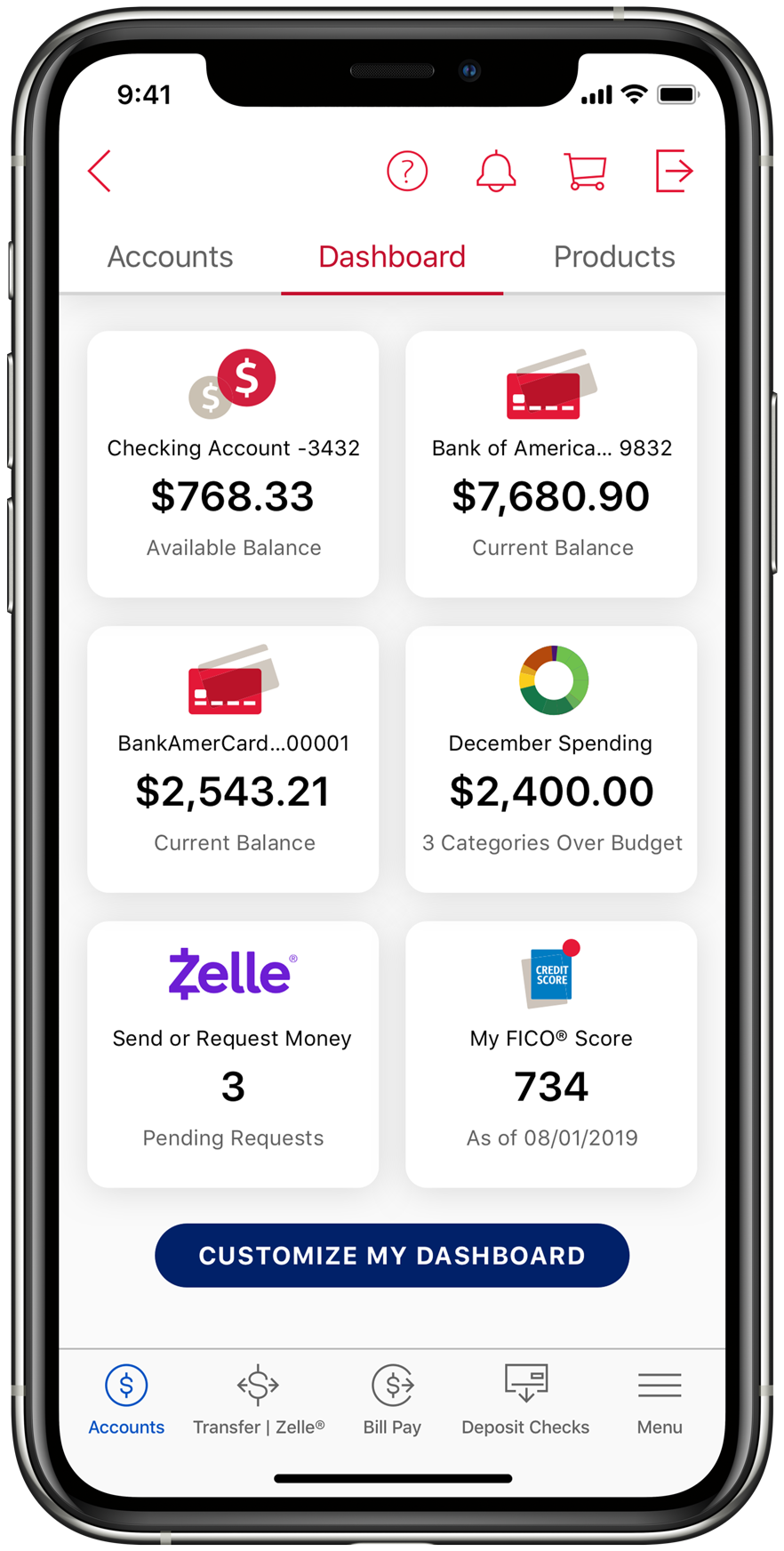

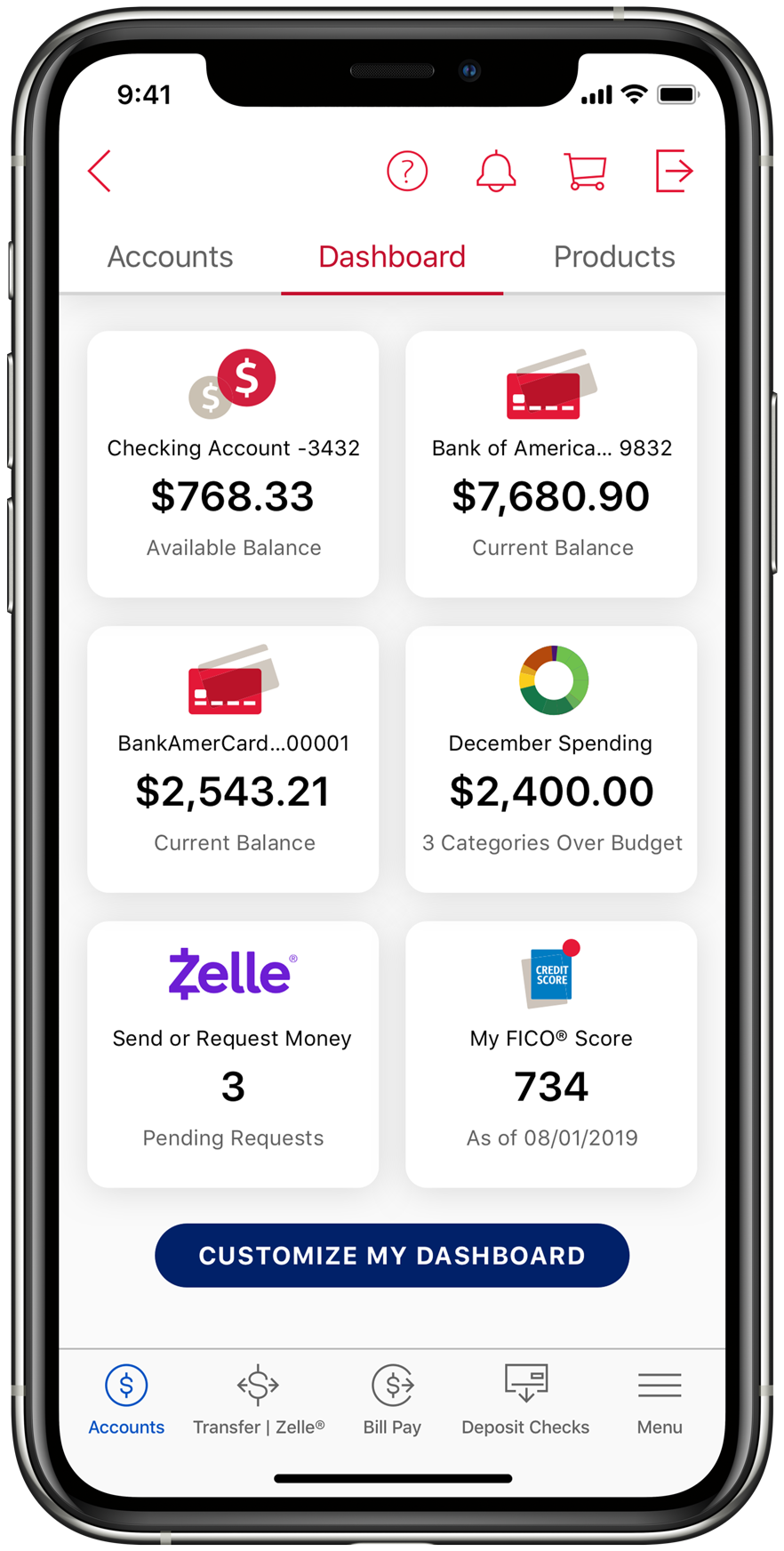

Always use the official May Access Bank App. Do not allow your device to connect to unknown wireless networks. If possible, disable the Wi-Fi and switch to your local cellular service provider’s network. Avoid banking while on public networks like coffee shops, restaurants or at the airport. Mobile devices are easy to carry around, and easy to be lost or stolen. Enable automatic locking mechanisms, such as a trace pattern, a PIN or even using a built-in biometrics reader, to protect your phone when not in use. Likewise, you should never send sensitive information such as account numbers, Social Security numbers or passwords via email or text message because these are often transmitted over the internet without any protection. As a reminder, we will never ask our customers for account numbers, passwords or other sensitive personal information by email, telephone, or text message.  If your device allows access via your fingerprint, pay special attention to prevent misuse, as it may also give access to your May Access Bank Mobile Banking app when Touch ID fingerprint authentication is enabled. Prevent unauthorized use and guard your User ID and password. Do not share your User ID and Password. What you can do to protect from mobile banking fraud We apply a number of security devices, checkpoints and procedures such as firewall systems and intrusion detection software, encryption of sensitive information while it is sent over the internet and when stored in our systems, internationally recognized security standards and industry best practices, and the use of application profile and password with context-based multifactor security. May Access Bank’s Mobile Banking application and mobile browser will then decode any encrypted information. We encrypt your personal information such as your user name, password and account information when you send it over the internet. Take these additional steps to understand what we do and what you can do to protect your mobile device. However, online security and protection of your identity and personal information is a team effort. May Access Bank has made it safe and secure to manage your bank account from almost anywhere, anytime on your mobile devices with the May Access Bank Mobile App for iPhone®, iPad® and Android™ devices.

If your device allows access via your fingerprint, pay special attention to prevent misuse, as it may also give access to your May Access Bank Mobile Banking app when Touch ID fingerprint authentication is enabled. Prevent unauthorized use and guard your User ID and password. Do not share your User ID and Password. What you can do to protect from mobile banking fraud We apply a number of security devices, checkpoints and procedures such as firewall systems and intrusion detection software, encryption of sensitive information while it is sent over the internet and when stored in our systems, internationally recognized security standards and industry best practices, and the use of application profile and password with context-based multifactor security. May Access Bank’s Mobile Banking application and mobile browser will then decode any encrypted information. We encrypt your personal information such as your user name, password and account information when you send it over the internet. Take these additional steps to understand what we do and what you can do to protect your mobile device. However, online security and protection of your identity and personal information is a team effort. May Access Bank has made it safe and secure to manage your bank account from almost anywhere, anytime on your mobile devices with the May Access Bank Mobile App for iPhone®, iPad® and Android™ devices.

0 kommentar(er)

0 kommentar(er)